Table of Content

The standard deduction and the additional amounts for blind and over age 65 filers are adjusted annually for inflation. Direct expenses are costs that only apply to your home office, such as furniture and equipment, supplies, and so on. For the simplified option of calculating your home office deduction, do the calculation on Line 30 of Schedule C for sole proprietors or single-member LLC members. For the actual-expenses option, you’ll need to use IRS Form 8829 to calculate these expenses. There are qualifications and limits for this deduction, so getting help from a licensed tax professional is an important first step to adding this deduction to your business tax return. You can take a tax deduction for your use of this space if you use it regularly and only for your business.

These expenses are deductible based on the percentage of your home’s square footage that your home office takes up (22% in the example above). The actual-expense deduction is used by businesses that have a larger space than 300 square feet or who want to get more deductions than the simplified method gives. This option works best for business owners who have only a small space, like a small storage area on their property or an office area in a bedroom, and use it regularly and exclusively for business activities. Taxpayers must meet specific requirements to claim home expenses as a deduction.

What is the simplified square footage method?

Buy and use separate computers, printers, and other electronic devices in your home office, so there’s no question that they are being used exclusively for your business. If your business is in a federally declared disaster area during the year, you may be able to deduct casualty losses for your home business. After checking out, return to "My Account" to view your course and online exam. If you purchase the "Hardcopy Book and Online Exam" option, you get online access to the course-PDF and exam, PLUS a printed copy of the course-book sent via USPS. Legislative BulletinsAnnual summaries of Minnesota tax law changes enacted during each legislative session.

If the office measures 150 square feet, for example, then the deduction would be $750 (150 x $5). For 2022, the prescribed rate is $5 per square foot with a maximum of 300 square feet. To do that, you compare the number of hours the child care business is operated, including preparation and cleanup time, to the total number of hours in the year . Your business-use percentage must be reduced because the space is available for personal use part of the time.

TaxWatch

But the tax code overhaul paused that ability until the provisions sunset at the end of 2025. “There’s good news and bad news,” Barbara Weltman, the owner of Big Ideas for Small Business, explained to MarketWatch. If you’re an employee filing taxes between 2018 and 2025, you cannot claim the deduction, she said. As an example — someone who works for Uber in their marketing department is likely an employee, even if they work from home. Whereas an uber driver, who is a contractor and self-employed, yet earning money from Uber, can deduct various business-related expenses as a self-employed individual and thus reduce their taxable income.

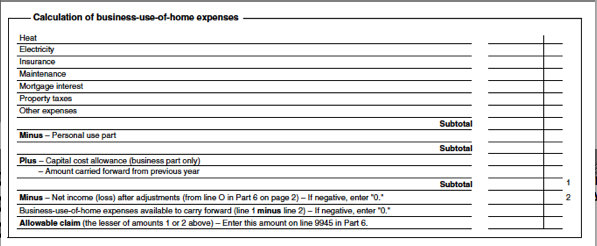

Special rules apply if you qualify for home office deductions under the day care exception to the exclusive-use test. • Generally, your home office must be either the principal location of your business or a place where you regularly meet with customers or clients, and you usually must use the area exclusively for your business. Home office business expenses are divided into direct and indirect expenses. Direct expenses are those for just your home office business space, like painting or repairing the space. To use the actual-expenses method, you’ll need the gross income from your business for the year .

Home Office Deduction #291822

As long as you use the home office to conduct your administrative or management chores and you don't make substantial use of any other fixed location to conduct those tasks, you can pass this test. Sign up to get the latest tax tips, information on personal finance and other key resources sent straight to your email. While working from home is convenient and comes with various perks, the increased utility cost and the need to purchase equipment to work efficiently can be a strain on your bank account. We encourage you to start a conversation with your employer about how they could help offset some of those extra costs — especially if you won’t be returning to the office any time soon.

Our Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they know it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid.

Regular Method

Alas, if you’re an employee who has been working from home due to the COVID-19 pandemic, that amazing home office tax deduction you’ve heard so much about does not apply. There are more and more people working from home, staring their own businesses and freelancing from home than ever before. As the state of the business world changes, and the focus turns to home-based, small and local businesses, and so too should your tax preparation. If you have a home office—one that you use for your own business, then you may be able to take the home office deduction, one that can save you a bundle on your taxes every year. Of course, it’s just as complicated as every other deduction, so always check with your accountant. In the meantime, here is a look at some of the deductions you can take when you have a home office and just how you can take them, according to the IRS.

Keep in mind that the requirements for who qualifies for the home office deduction doesn’t change based on which deduction method you use. First, calculate the percentage of your home-office area used for businesses by dividing the total home area by your office area. Let’s say your total home area is 1,800 square feet and your home-office business area is 396 square feet. The home business space to use for calculations is 22% of the home space.

Indirect expenses are costs that don’t exclusively apply to your home business, such as utilities, rent, mortgage insurance, real estate taxes, security system fees, and similar costs. To find the deductible percentage of these costs, you divide the total square footage of your home by the number of square feet in your home office. For taxpayers going down this route, the Schedule C form will ask for the total square footage of a home and then it will ask for the square footage of the home used for business.

The other way of calculating the deduction can be a “major tax saver,” Bischoff said. Assume you use 40% of your house for a daycare business that operates 12 hours a day, five days a week for 50 weeks of the year. Remember that the requirement is that your home office is your principal place of business, not your principal workplace.

With either method, the qualification for the home office deduction is determined each year. If you're an employee of another company but also have your own part-time business based in your home, you can pass this test even if you spend much more time at the office where you work as an employee. Clearly, if you use an otherwise empty room only occasionally and its use is incidental to your business, you'd fail this test.

The tax reform of 2017 eliminated the deduction of unreimbursed employee expenses. With TurboTax Live Full Service Self-Employed, work with a tax expert who understands independent contractors and freelancers. Your tax expert will do your taxes for you and search 500 deductions and credits so you don’t miss a thing. You can also file your self-employed taxes on your own with TurboTax Self-Employed.

Here’s what taxpayers need to know about the home office deduction

See the worksheet on page 25 of IRS Publication 587 for the rest of the calculation. Jean Murray, MBA, Ph.D., is an experienced business writer and teacher who has been writing for The Balance on U.S. business law and taxes since 2008. Accountant Kathy Pickering says most of those forced to work at home can’t claim the home office deduction, even if an employer required them to work remotely due to the spread of the coronavirus. Still unsure about if you qualify for any home deduction benefits, or do you have other questions related to your tax situation? If a person owns the home, they can tack on costs like property taxes and mortgage interest, Goldberg noted. Forty percent of the space is devoted to a home office, so a person seeking the home office deduction can tally up things like their rent, utilities, renters’ insurance and improvements to the apartment.

No comments:

Post a Comment